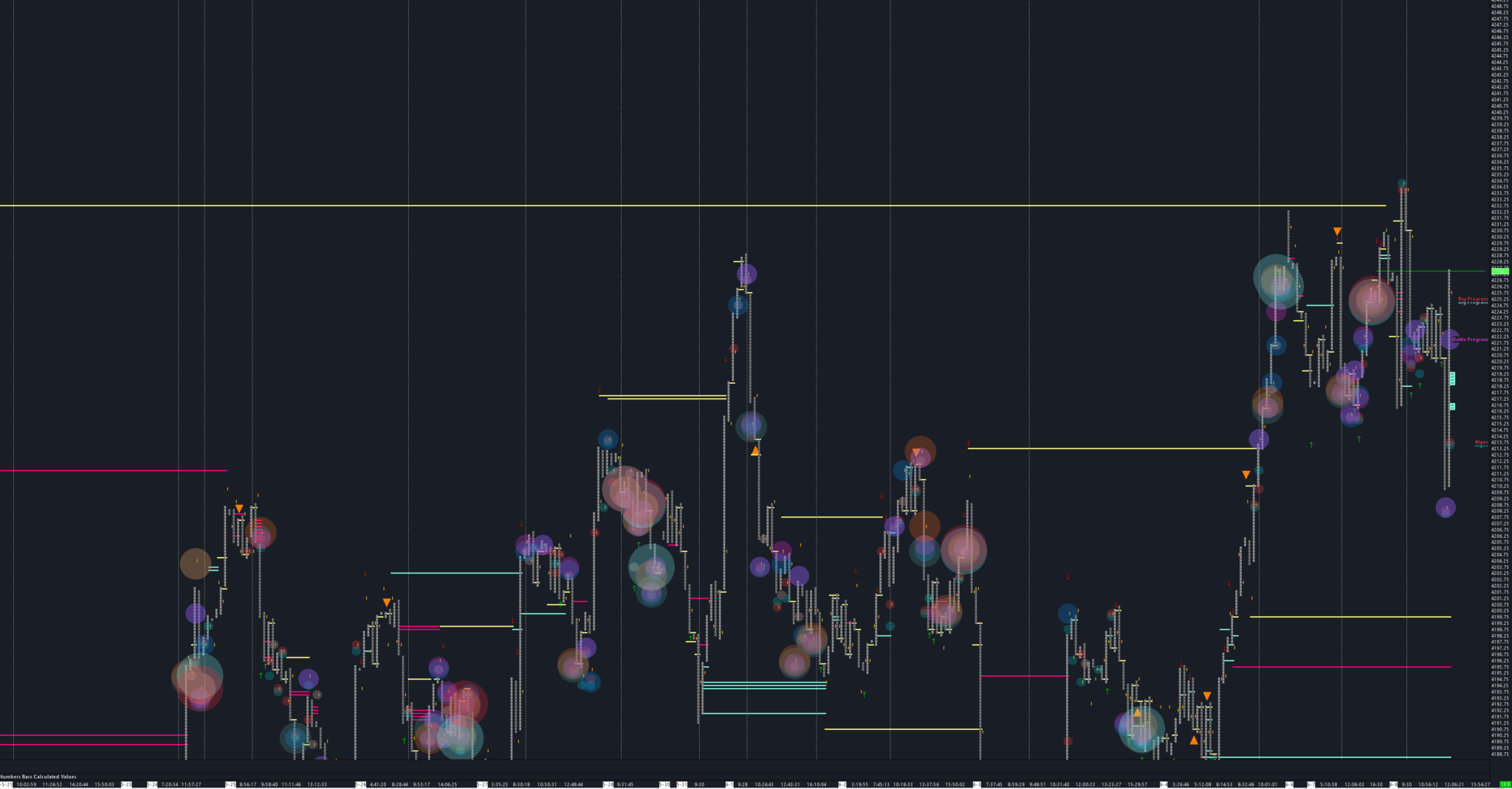

dark pool

Big institutions filled their orders in Dark pools. you can know when they favour buying or selling to make bid ask spread profit to predict the next potential move

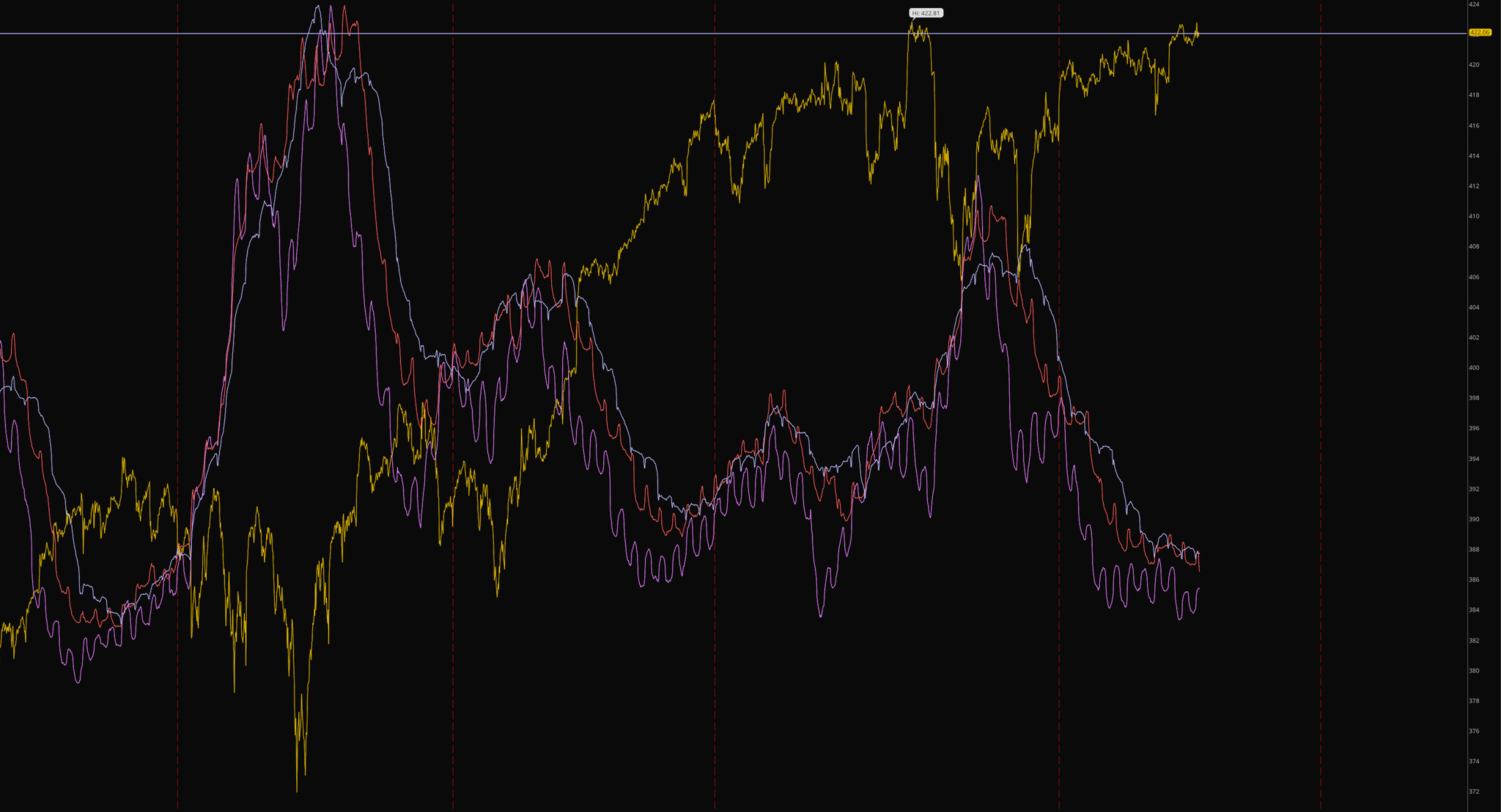

MMB Bull Bear Algos

Futures Dark pool

F.A.Q.

A measurement of the unusual amount of Darkpools, Algos, Buy/Sell order in the underlying asset ( Combination of Anomalous Buying or Selling activity in option sweep orders

High positive Depth environment: low volatility, smaller moves in the markets, Key price level supported by Dealers hedging, which means you can expect price slow grind to a higher level, or narrow range up and down like “ Ping-pang “ trade with Bulls. ( Bulls in Control)

High negative Depth environment: high volatility, larger price moves in the markets, Key price level defenced by Dealer hedging ( they like short futures to Protect their portfolios) fast directional change after key price level break, which means, you can use resistance key price level as Short zone, only trade with Bears. (Bears in Control)

Mixed Depth +- environment: mix volatility, big consolidation zone. The bulls and Bears aggressively running algorithms to wash weak players out. Market Direction unclear ( perfect time to plan Swing trade). Short and Long all works. ( Transition Trend)

Predict Market Maker Hedging changes relative to the volatility of the underlying index, Market maker apply futures Algos to Hedge instant Risk

High positive Depth environment: low volatility movement, dealers have to sell futures to their long positions, Slow grind bull skew trend, valiant bears short every new high but failed every time, squeeze to a higher level

High Negative Depth environment: High Volatility movement. Dealers are willing to cover their short futures ( buyback) to offset their delta exposure. ( recall recent market Dip $405, $406)

Our Gap up and Go, Gap down and Go indicators, Predict price levels which options market makers position shifts from selling volatility to buying volatility, ( buying to selling ) which detect market makers hedging flow shift from holding a supportive level (or breakout) to next level instantly.

Negative Depth environment (VIX$, VVIX + spike up so, ) Initial phase of Bears in the control environment, ( BETA or Booster >= -10 negative energy active ) we expect the price to retest the Positive Booster level first. If the Levels cannot Hold ( Bears money injection successfully to pressure the booster support level$415( support become a resistance), the Market maker will active short futures to hedge, which result in Dealer position shifts from Holding or buying to Net Short (recall recent Market Top 420 -405 correction ) (Dealers who long Vix, Vvix could taking profit after market Drop)

High Negative Depth environment ( High VIX%%EDITORCONTENT%%gt;20$, VVIX >120$) terminal phase of Bears in the control environment, ( But booster >= +110 positive energy back ) we expect the price to test the extreme Negative Booster level first. If the price cannot breakdown ( Bears money injection fail to pressure the booster support level, the Market maker will pause Net short futures activity, which results in Dealer position shifts from Selling to buying (short covering recall recent Market Dip $405, 406)

High Positive Depth environment ( Low VIX$ VVIX ), Bulls in the control environment, 1: we expect slow grind up with low booster energy+ ( booster <= +_20) retest previous Booster level and recharge the upside boost potential. 2: fast price movement when ( booster > 50+) ( Long only environment, recall recent consolidation between 415- 420 )

Smart Money’s footprints

Hedge funds primarily choose to trade the dark pool as they can hide their activity. Normally big portfolios are built and their transaction invisible to the public, As FINRA ( Financial Industry Regulatory Authority) requires all dark pool transaction posts within 72hours, therefore, we can read the Dark pool transaction data.

We aggregated S$P500 data within the last 7 trading days

When Price Above Hedge Fund level Bullish

When price Below Hedge Fund level bearish

Futures DarkPools detect futures trading transactions instantly as Market maker hedge their portfolio ( Options ) with futures. After Combine with FINRA dark pool data with our unique Futures Dark pools data. We come up with our unique trading entry strategy. Bear Algo, Bulls Algo, Battle Algo